Definition

An option gives the option holder a choice to buy or sell a pre-agreed asset at a certain pre-agreed price.

Description

There are 2 main types of options: 1) Call option and 2) Put option.

Call options gives the option holder a choice to buy a pre-agreed asset at a certain pre-agreed price.

Put options gives the option holder a choice to sell a pre-agreed asset at a certain pre-agreed price.

This pre-agreed asset is called the underlying asset, in other words, it is the asset that is attached to this option.

This pre-agreed price is called the strike price.

Example of an Option Trade

Call option example:

Trader A buys the Apple’s call option at strike price $190. In this case, Apple is the underlying asset.

Let’s assume Apple is trading at $180 today. Trader A’s call option is not very valuable as we can buy Apple stock directly for $180. Thus, we don’t want to exercise the choice to buy it at $190 (a more expensive price).

If Apple goes to $200 tomorrow, Trader A’s call option becomes more valuable. We can now exercise our choice to buy Apple at $190 and immediately sell Apple at the exchange for $200 (a $10 profit).

Put option example:

Trader B buys the Google’s put option at strike price $1200.

Let’s assume Google is trading at $1300 today. Trader B’s put option is not very valuable as we can sell Google in the market for $1300. Thus, we don’t want to exercise the choice to sell it at $1200 (a lower price).

If Google drops to $1100 tomorrow, Trader B’s put option becomes more valuable. We can now immediately buy Google from the exchange at $1100 and exercise our choice to sell Google at $1200 (a $100 profit).

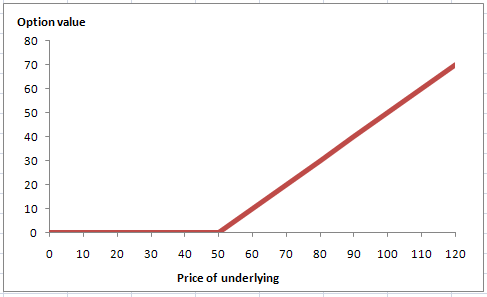

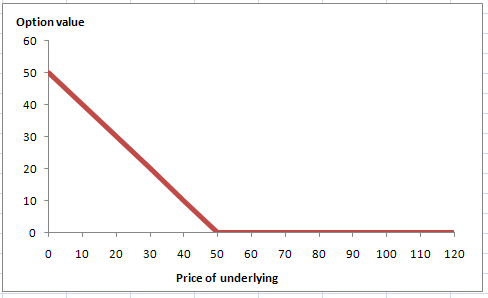

Payoff Charts

We use charts to get a better look at our payoffs, i.e. how much we will make (or lose) as the underlying asset’s price moves.

From the diagram above, we can see that when the payoff is:

- $50. The payoff is $0.

- $40. The payoff is $10.

- $30. The payoff is $20.

- $20. The payoff is $30.

This makes sense as if we own this put option when the underlying is $30, we can immediately buy the underlying from the exchange at $30, and exercise our choice to sell it at $50. Thus, netting a $20 profit.

To exercise an option means to buy or sell the underlying assets at the pre-agreed strike price.

Moneyness

Moneyness describes how we name options at different profit or loss levels. There are 3 terms used to describe this:

- In-the-money (ITM): Our payoff is positive.

- At-the-money (ATM): Our payoff is zero. Strike price = Underlying asset’s price.

- Out-of-the-money (OTM): Our payoff is zero (or negative after considering the cost of the option).

- For call options, strike price is greater than underlying asset’s price.

- For put options, strike price is less than underlying asset’s price.

Expiration

Options expire at a certain pre-agreed date.

If the options holder did not exercise the option by then, the option becomes worthless if it is ATM or OTM. If the option is ITM, it will be automatically exercised.

Cost of Options (Premiums)

If the stock goes higher than your call option strike price, you make profits. If it doesn’t, you don’t make losses. It might seem like a deal too good to be true.

And yes, it is.

The catch is that you need to pay to buy call or put options. The costs of the option is known as the premium.

The premium goes up as the the option gets more ITM as we need to take into account the profit already accumulated by this option.

The premium goes down as the option gets less ITM as we need to take into account that the profit is far in sight.

The premium shifts your diagram down, as you need to earn the premium amount before you go on to make a profit.

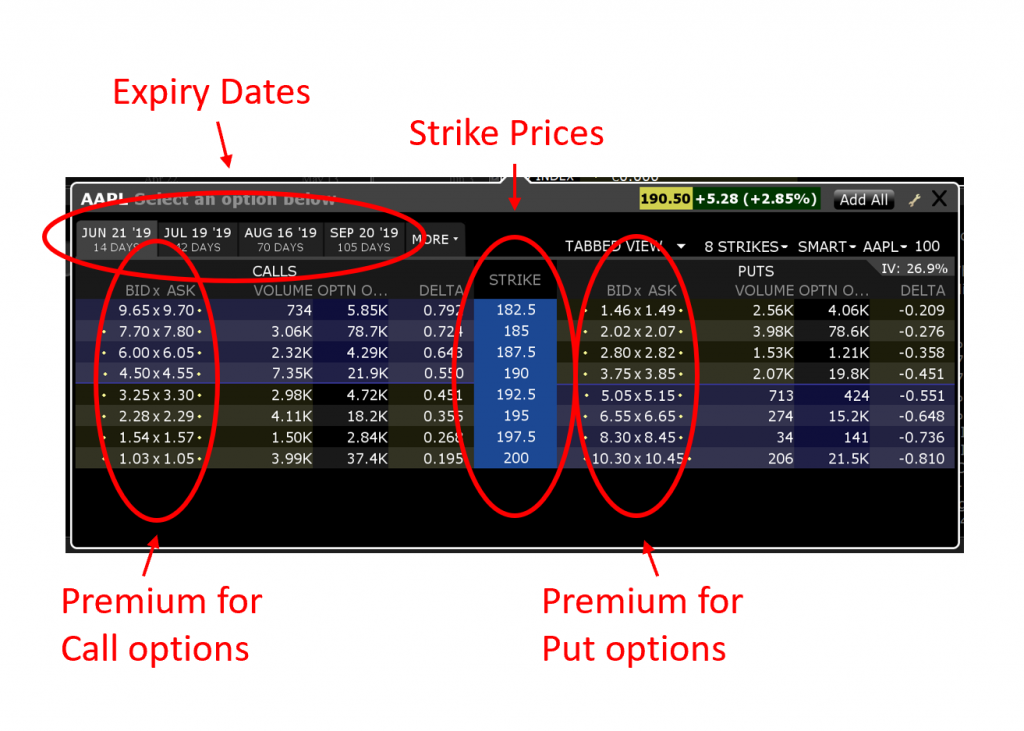

This is an example of some of Apple’s options as viewed in a trading terminal:

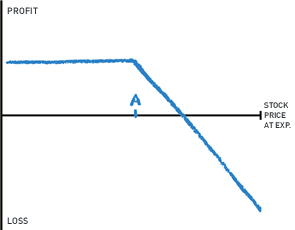

Selling Options

Traders are able to sell options too. The payoff will be the exact opposite of that of an option buyer.

In this case we are selling that option without first owning it. When you do that, you are said to have shorted that option.

Option buyers pay a premium and hope that the option goes ITM.

Option sellers receive a premium and hope that the option does not go ITM.

In this aspect, options seller have a limit on how much they can make but their potential losses are unlimited. Vice versa for option buyers.

Short put option payoff diagram.

Credits to optionsplaybook.com.

Option Combinations – Strategies

You can combine different options to create unique structures. Here is a short non-exhaustive list:

- Straddle

- Put Spreads

- Iron Condor

Straddle

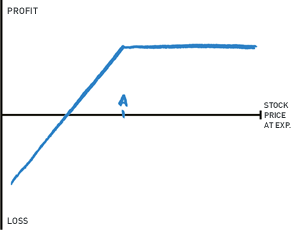

When Trader A buys a call option and a put option at the same strike price, the resulting position is a long straddle.

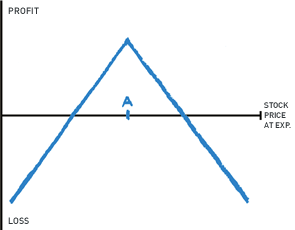

Credits to optionsplaybook.com.

The above is your payoff diagram when you long a straddle.

You long a straddle when you want to bet that there is going to be a big move, but you’re not sure if the move will be up or down.

The cost of this trade is double that of a regular call or put option.

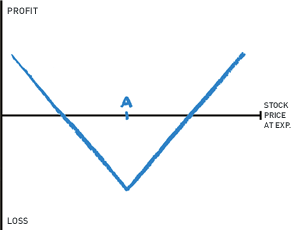

Credits to optionsplaybook.com.

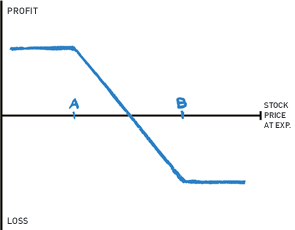

The above is your payoff diagram when you short a straddle.

This involves selling a call and put option at the same strike price.

You short a straddle when you want to bet that there isn’t going to be much movement.

Put Spread

When Trader A sells a put option at strike price A and buys a put at strike price B (where B is greater than A), the resulting position is a long put spread.

The rationale of this trade is that you want to bet that the underlying asset will fall by a little. But you want some insurance to protect yourself if the price rises.

The long put option at strike price B will provide that insurance. The cost of this insurance is the premium of that put option.

A long put spread is also known as a bear put spread or vertical spread.

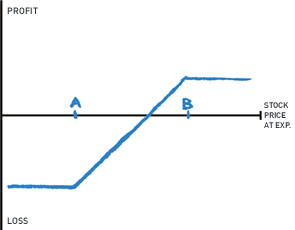

When Trader A buys a put option at strike price A and sells a put at strike price B (where B is greater than A), the resulting position is a short put spread.

The rationale of this trade is that you want to bet that the underlying asset will rise by a little. But you want some insurance to protect yourself if the price falls.

The long put option at strike price A will provide that insurance. The cost of this insurance is the premium of that put option.

A short put spread is also known as a bull put spread or vertical spread.

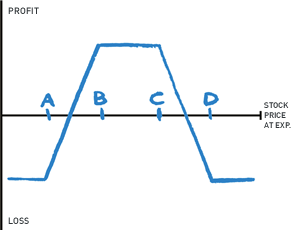

Iron Condor

The iron condor is formed by buying a put option at strike A, selling a put option at strike B, selling a call option at strike C and buying a call option at strike D.

The rationale of this trade is that you want to bet that the underlying stock price will stay between B and C.

You give up some profits (when the underlying is between B and C) in order to gain some premiums from selling 2 options, to reduce the cost of this structure.

We have only listed 3 option strategies that can be made by combining options and stocks. Here are 40 more option strategies: Options Strategies – Optionsplaybook.com

Why Trade Options

- To create creative trades by trading structures as seen in the above section.

- To hedge certain exposure. Think of this as buying insurance on your trades by giving up potential gains.

- To leverage. Option premiums are relatively low compared to the potential gains. (This doesn’t mean trading options is generally profitable.)

Regular Options

These are common options that are traded in the markets.

American Options

These are the most common options which can be exercised anytime. Despite it’s name, it has nothing to do with American stocks.

European Options

These are options which can only be exercised on expiration. Despite it’s name, it has nothing to do with European stocks.

Exotic Options

There also exist unique options with quirky features.

Barrier Options

These come into existence or become worthless once the underlying asset reaches a certain pre-agreed price.

Asian Options

Asian options’ payoffs are determined by the average price of the underlying asset over a pre-set period of time.

Basket Options

Basket Options are based on more than one underlying asset. The payoff of the basket option is based on the average price of a group of underlying assets.

Lookback Options

Lookback options have no strike price initially. On the expiry date, the option holder will choose a strike price among all the prices that have occurred during the lifetime of the option. Usually the holder will choose the most favorable strike price.

We have covered 4 exotic options, read about another 8 more here: What are Exotic Options – Corporate Finance Institute.

Links to Other Explanations

Related Terms