Definition

Algorithmic trading strategies refer to methods in which we can use algorithmic trading to profit in the financial markets.

Types of Algorithmic Trading Strategies

- Alternative Data

- Correlation

- Mean Reversion/Cointegration

- Order Limit Book Analysis

- Derivatives Structuring

- Quantitative Investing

- High-Frequency Trading

- Machine Learning

The above list is not exhaustive or mutually exclusive.

Alternative Data

The 5 main types of alternative data are:

- Location Data

- Credit Card Data

- Satellite and Drone Images

- Weather Data

- Web Presence Data

- Web Traffic

- Social Media Popularity

- Job Listings

The above list is not exhaustive or mutually exclusive.

Analyzing alternative data allows us to predict the future price movements of financial assets.

Example

Hedge fund X bought credit card data from a credit card company. It analyzed the data and realized a huge number of Walmart products were bought in the last 3 months. It then buys Walmart shares.

Read more about Alternative data types and vendors: What is Alternative Data?

Correlation

When 2 assets move in a similar manner, we say they are correlated.

Traders prefer one asset to move slightly later than the other asset. This lag gives traders an opportunity to trade the lagging asset while using the leading (earlier moving) asset as a reference.

Example

After the US bond futures move, the Australian bond futures tend to move. Trader Y will trade the Australian bond futures using the US bond futures as a reference.

Read how to use Google Search data as a leading indicator: Using Google Trends To Predict Stocks

Mean Reversion/Cointegration

In some cases, when the prices of 2 or more assets move away from one another, they tend to converge eventually.

Mean reversion trading revolves around making a bet that such an occurrence will happen.

Mean reversion trading is also known as:

- Cointegration Trading

- Relative Value Trading

- Trading Diverges and Convergences

- Spread Trading

Types of mean reversion strategies:

- Hard Arbitrage

- Statistical Arbitrage

- Futures calendar spreading

- Hedging strategies

- Index Arbitrage

Example

Stock Index A is made up of 10 stocks. We calculate the price that Stock Index A should be trading at. If our calculated price is lower than the actual traded price, we buy the 10 stocks and short Stock Index A.

We do that in hopes that the value of Stock Index A moves towards the value of our 10 stocks.

Price behaviour of a combination of 3 bonds futures.

Long one unit of Bond A, Short 2 units of Bond B and Long 1 unit of Bond C.

Read more about futures spread (pair) trading: Basics of Futures Spread Trading

Order Limit Book Analysis

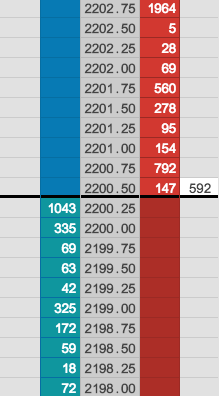

An order limit book is a live record of the number of people queuing to buy an asset at certain prices.

An example of an order limit book. Some traders are queuing to buy 1043 units at $2200.25, and some are

queuing to sell 147 units at $2200.50. Source: https://www.tradingtechnologies.com

An order limit book is usually accompanied by a list of trades that were transacted. This list is known as time and sales data.

The order limit book and time and sales data allow traders to identify patterns in the market that they can exploit.

Example

Trader Z uses machine learning to find out that someone is consistently buying the E-mini S&P 500 Futures (this is a US stock future contract) at $2800 during certain times of the day.

The trader then proceeds to buy this contract if it is priced below $2800 and sells the contract to that mystery buyer at the appropriate time.

Order Limit Book is also known as:

- Depth of Market (DOM)

- Level 2

- Ladder

Quantitative Investing

Quantitative investing entails using models to choose investments for the longer term. These models are factor models, meaning they take into account a few (or a lot of) factors.

Examples of Factors:

- Correlation to the markets

- Difference between performance of small and large stocks

- Momentum in the markets

- Correlation between sectors and industries

- Correlation behind industries

- Risk-loving vs risk-adverse behaviors

Some hedge funds might use up to 100 factors in their models. It is debatable whether using more factors results in better predictive value.

Example

A simple model could look like:

Stock A’s predicted return = Overall Market Interest Rate + X * Overall Market Returns + Y * Momentum in the Markets + Z * Change in Risk-Loving/Risk-Adverse Behavior + Alpha

Overall Market Interest Rate + X * Overall Market Returns + Y * Momentum in the Markets + Z * Change in Risk-Loving/Risk-Adverse Behavior + Alpha

Where X, Y, and Z are the weights given to each factor

Read how a $200B hedge fund conceptualize its factor models: Our Model Goes to Six and Saves Value From Redundancy Along the Way

High-Frequency Trading

Main article: High-Frequency Trading

High-frequency trading (HFT) describes trading that require high computing and communication speeds.

HFT is characterized by high communication and computing speed, large number of trades, low profit per trade and expensive software infrastructure.

High-frequency traders use communication speed to profit and outwit other traders.

Example

When a traditional (slower) hedge fund buys a large number of Stock A, a HFT hedge fund will detect that.

The HFT hedge fund will then buy all the Stock A at the other exchanges and sell it back to the slower hedge fund for a small profit.

The HFT fund might do this millions of times over a day.

Read more about how a quant department get an edge by being slower: The Stock Market had become an Illusion

Machine Learning

Main article: Machine Learning

Machine learning is not a type of trading strategy. It is a tool kit for use to conduct analysis. However, it is popular enough to warrant its own section.

Machine learning techniques allow computers to do things without being told explicitly how to do it.

The advantage of machine learning includes:

- Being able to analyze large quantities of data without being explicitly told what to look for

- Being able to read texts (in large quantities and difference languages) and derive meaning

- Being able to understand images

- Being able to analyze and output a prediction fast

Example

Traders analyze satellite images of oil storage silos to see how much oil is in them. The lesser the oil supply, the higher the expected price.

They do that by checking how the shadows are casted inside these silos (apparently these silos have floating roofs that move up and down according to the amount of oil in them).

Using machine learning, the computer can evaluate the quantity of oil in each silo.

Read how AI read tons of news to give you trading insights: AI Mines Hundreds of Thousands of News Articles Per Hour for Stock Tips

Related Terms